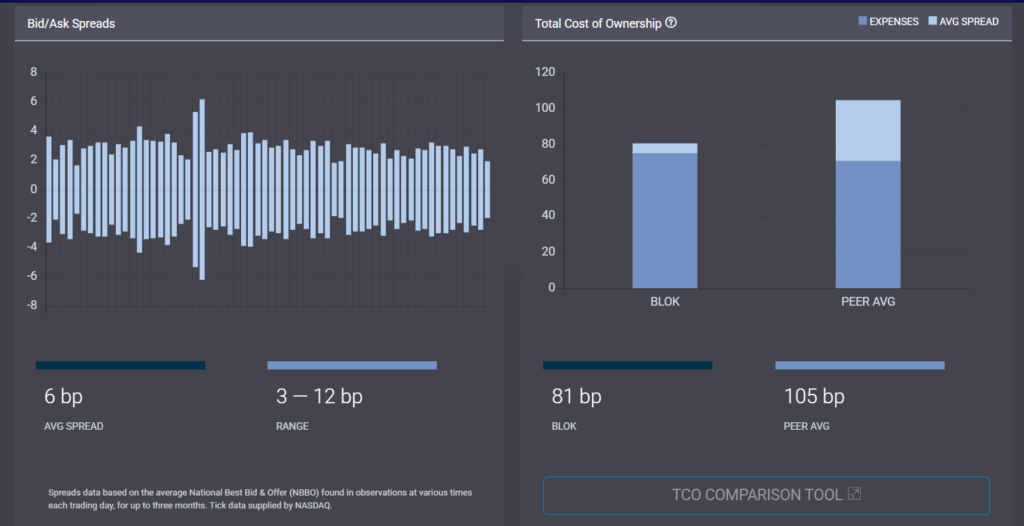

ETF Research Center is excited to announce the addition of a new dataset to our platform: comprehensive bid/ask spread history for more than 3,000 ETFs. The new charts show how spreads have evolved over time and capture not just the average, but also the range—from the tightest to the widest spreads observed. This offers investors a realistic sense of what they might pay to trade under both normal and volatile market conditions.

Wide spreads can

quickly offset years

of savings on fees

Our ETF spread data is calculated using the National Best Bid and Offer (NBBO) observed at various times throughout the trading day, providing a detailed and representative measure of real-world trading costs. To our knowledge, this type of data is not readily available to most investors without access to costly institutional platforms like Bloomberg. Although some sites may display a current or delayed quote of the bid/ask spread, that single snapshot tells only part of the story—our data reflects the trading experience over time.

This enhancement also powers our Total Cost of Ownership (TCO) analysis, which combines expense ratios with average trading spreads to estimate the true cost of holding an ETF. Many investors focus primarily on expense ratios, but since differences between funds often amount to just a few basis points, even a slightly wider spread can quickly offset years of savings on fees. Our TCO tool helps investors make better, more comprehensive cost comparisons.

You can explore this data on any ETF’s focus page under the “Trading & Costs” tab, such as shown here: BLOK. The left-hand chart shows the historical bid/ask spreads, while the right-hand panel compares total cost of ownership for the fund’s peer group (in the case of BLOK, 130 actively managed Global Equity ETFs). For a direct, side-by-side comparison between any two ETFs, visit our TCO Comparison Tool.

With these new insights, ETF Research Center continues to make institutional-grade analytics accessible to all investors—helping you trade and invest smarter, not just cheaper.

Staying Up-To-Date

Stay on top of changing markets with critical investment analysis on over 3,000 U.S. and Canadian ETFs by joining ETF Research Center!