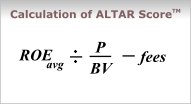

How we rate ETFs. Ultimately the goal of conducting investment research is to help investors make money. To that end, we calculate an ALTAR Score™—short for AltaVista Long Term Annual Return forecast—for each ETF we cover, which summarizes the results of our fundamentally-driven analysis.

ALTAR Score™

The ALTAR Score™—short for AltaVista Long Term Annual Return forecast—is our measure of an ETF's overall investment merit. It was designed to evaluate passive index funds like ETFs based on their underlying holdings, in contrast to most performance-based rating systems which were designed decades ago to evaluate the managers of active mutual funds. Expressed as a percentage, the ALTAR Score™ helps facilitate comparisons between funds, both within an across fund categories.

Recommendations

For equity ETFs we also distill ALTAR Scores™ into a traditional five-tier recommendation system based on how each fund's score ranks in relation to the other ETFs in its category. Our recommendation tiers are as follows:

- SPECULATIVE

- A rating of SPECULATIVE is assigned to ETFs with ALTAR Scores in the top quintile (the top 20%) of their category, indicating exceptional appreciation potential. However, often these are narrowly-focused funds or in industries with structural issues, which may also make them very risky. Nonetheless they may still be useful as part of a well-diversified portfolio.

- OVERWEIGHT

- A rating of OVERWEIGHT is assigned to ETFs with ALTAR Scores in the 4th quintile (ranking higher than 60%-80%) of their category. Typically, funds in this category consist of stocks trading at attractive valuations and/or having above-average fundamentals.

- NEUTRAL

- A rating of NEUTRAL is assigned to ETFs with ALTAR Scores in the middle quintile (ranking between 40%-60%) of their category. This indicates that valuations adequately reflect the fundamentals of stocks in these funds.

- UNDERWEIGHT

- A rating of UNDERWEIGHT is assigned to ETFs with ALTAR Scores in the 2nd quintile (ranking higher than only 20%-40%) of their category. Typically, funds in this category consist of stocks trading at relatively expensive valuations and/or having below-average fundamentals.

- AVOID

- A rating of AVOID is assigned to ETFs with ALTAR Scores in the lowest quintile (the bottom 20%) of their category. Often, funds in this category consist of stocks with little if any history or expectation of profitability, and as a result our fundamentally-driven analysis may be less relevant.

Benefits to Investors

The ALTAR Score™ works differently by helping you find value going forward, not simply telling you what has performed well up until now.

Investing is about the future, yet most firms' ETF ratings are based on past performance. As a result, they encourage investors to allocate assets to areas that have already increased in price significantly, and away from those that have already fallen. Simply put, this is a buy-high, sell-low strategy!

The ALTAR Score™ works differently by helping you find value going forward, not simply telling you what has performed well up until now. This encourages investors to dynamically allocate assets away from areas that may be overheated— where fundamentals have not kept pace with price increases—and into areas of more value, where prices may not fully reflect underlying fundamentals. Over time, this strategy will help investors profit from mean-reversion, whereas a performance-based rating system may suffer.

There are many other benefits to this approach. One is that new funds can be rated immediately, whereas a performance-based system typically requires three years or more of data before a rating can be determined. This leaves out a significant portion of growing ETF universe!

Another benefit is that ALTAR Scores™ are comparable across fund categories and even asset classes. It can help an investor not only determine which Emerging Market ETF, for example, is best for his or her portfolio, but also determine whether how much to allocate to Emerging Markets in light of opportunites in U.S. and other developed market equities. In contrast, performance-based ratings are all relative to category benchmarks, and provide no information about the relative attractiveness of the categories themselves.

ALTAR Score™

- Designed for index funds like ETFs

- Evaluates funds based on holdings

- Works with new funds on day one

- Forward-looking

- Favors areas with room for future appreciation

- Profits from mean-reversion

- Enables comparisons across categories and asset classes

Performance-based Rating

- Designed for actively managed mutual funds

- Evaluates skills of fund manager

- Requires years of data

- Backwards-looking

- Favors areas that have already outperformed

- Suffers in mean-reversion

- Meaningless outside of category